In 2014, I earned over $1200 for travel.

Not very impressive until you know that I earned this passively.

How did I do it?

Through my credit card.

I know, credit cards are supposed to be money pits, right?

But if you play your cards right, you can end up with hundreds of dollars of passive income every single year.

Realistically, you could use passive income from your credit card to pay for your vacation each year.

Here’s how:

1. Find a credit card with an awesome sign-up bonus.

Try Ratehub.ca’s credit card comparison tool. I am not affiliated with Ratehub in any way and don’t get any kickback from recommending the tool, I just think it’s awesome.

If you’re actually using the money you earn in passive income from your credit card for a vacation, then sort for travel cards.

Why?

The sign up bonus will make up a big portion of your passive income from the credit card.

You’ll generally make more for points rather than cash-back, so by going for a card that will give you points instead of a rebate, you’ll come out ahead.

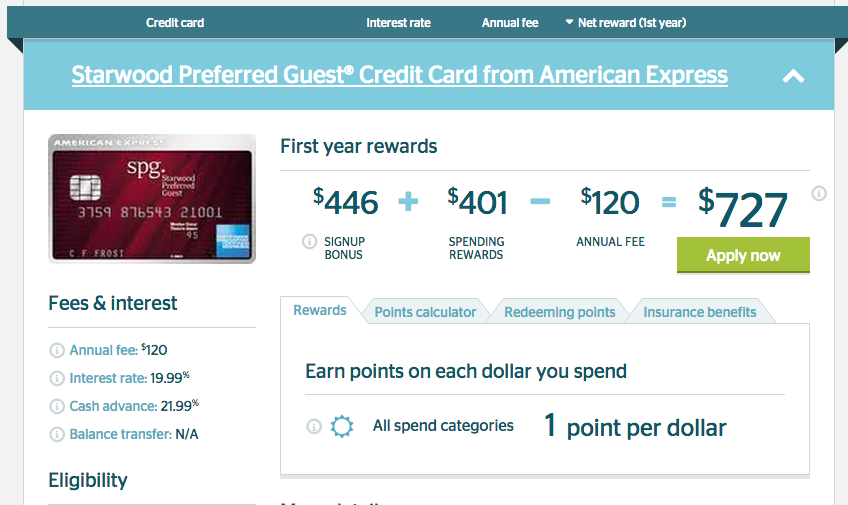

As you can see, the card in the photo below shows that there is a sign up bonus of the equivalent of $446 in points.

You can usually find cards with the equivalent of $300-$400 in sign-up bonuses.

2. Subtract the Annual Fee (Or, find one without)

It seems obvious to you, right?

That an annual fee would eat into your earnings.

After all, if you get a sign up bonus of $300, but the annual fee on the card is $250, you’re really only getting a sign up bonus of $50.

But to some people (who aren’t as smart as us), it’s not as obvious.

So go ahead and subtract the annual fee from the sign up bonus.

In the example above, the annual fee is $120.

Some cards have bonus offers and waive the annual fee for the first year. This is ideal. You’ll be cancelling this credit card before the next annual fee is due anyway.

3. Order the Card

Once you find a card with a generous sign-up bonus and have considered the annual fee, order the card.

If you are married or in a relationship, don’t order one for both of you, and certainly don’t put your spouse on your account.

Nope, we’re not trying to do anything shady here, we’re just making sure you make the most passive income possible.

Move on to step 3 a if you do have a spouse or partner. If not, skip over to step 4.

3(a). Make a Big Bonus

Congratulations, you have a built in bonus!

And you can earn far more passive income.

Here’s what my husband, Jason and I always do in these situations:

- I order the card, and wait to recieve it

- When I get it, I activate it, and find out whether they have an affiliate or referral program*

- If the card does have a referral program, I send Jason the referral link

- Jason signs up under my referral link, giving me a kickback (usually of about $100 or 10,000 points).

*Bonus: almost all American Express card programs do. Chase cards do, most others do not. The easiest way to find out is to log in to your account and search for “refer a friend” or “refer”. Alternatively, do a Google search. For our sample card in the screenshot above,

He also gets the sign-up bonus, of course.

After you’ve done this, if applicable, you can move on!

4. Spend, Spend, Spend.

From here on out, every single dollar you spend needs to go on your credit card.

That’s the only way you’ll make more passive income.

No, don’t go out and spend more to get points.

And obviously, pay off your credit card before it incurs interest each month. If you incur interest on your credit card you’ll negate any earnings from the card.

Every time you fill your car up, each grocery shop, kids sports, bills, everything should go on that credit card for points or rebates.

5. Collect and Cancel

DO NOT forget this part.

Set a reminder for yourself if necessary, but whatever you do, don’t forget to do this:

Cancel your credit card.

After you’ve had the card for juts under a year, phone and cancel it. You don’t want to incur the yearly fee.

No excuses. I don’t care if you love the card – you want to earn more passive income by opening another card and the only way is to cancel your current card and open another with a great sign up bonus.

If you have a card that collects points, then check to see if you need to spend them before you cancel.

With the American Express Gold Card, you do need to spend them before it cancels. So we just booked our trip with them in the future and then cancelled the card once the flights were booked.

6. Rinse and Repeat

After you’ve cancelled your card in 2016, you can rinse and repeat.

But I would encourage you to do this with another card in 2015.

That way, you can double your points.

Jason and I earned $1200 this year from this – each.

Some were cash-back credit cards, and some were in points that we used on the travel we would have had to pay for.

And no, this will not hurt your credit. Unless you’re opening 8 credit cards each year and cancelling them right away, this is completely safe.

Jason and I both have excellent credit, and we do this with 3-4 cards each year. We keep them for the entire year, spend on them, and then move on.

If you don’t do this, you’re passing up the potential for some easy passive income each year.

Don’t be that person.

Don’t be the passive income passer upper.

Make your extra money and enjoy it.

Don’t spend it all in one place.

So…I’m sitting on about $6k+ of statement credits I could redeem. But, we love traveling so much, it is hard to redeem them for cash. I haven’t tallied up what I did in 2014, but it was a lot. Especially since I travel a fair bit for work and put everything on my personal cards. My favorite is getting about $100 cash back for a work trip, a free hotel room every other trip worth $150/night and about 15k worth of points. Multiply by 15-16 trip/year plus our normal spend plus some side shenanigans …. We average over 1000 pts/miles earned per day for the entire year. Plus credit card sign ups 🙂

I’ve been really trying to convince myself to churn a card that I get offered in the mail all the time. Might need to go for it now to not be that person!

I love credit card rewards. I think they are great for people who are responsible enough to pay off the card each month, I’ve been doing this for years now. The one thing that I really hate is the churn of credit cards. It’s really a shame that there are usually annual fees on these cards. At least canceling credit cards every year is easier than switching cable companies…. That is so much more of a hassle.