First, what does GnuCash do?

According to its website, GnuCash is a “personal and small-business financial accounting software, freely licensed under the GNU GPL and available for GNU/Linux, BSD, Solaris, Mac OS X and Microsoft Windows.” This free software is designed to not only be flexible but also to track a variety of accounts, from your bank to your stock.

Highlighted features of GnuCash includes but is not limited to: small business accounting, reporting, stock and mutual fund accounts, scheduled transactions, and double-entry accounting.

For the individual on the go, an Android app exists for mobile financial tracking. Additionally, the program offers check printing, mortgage and loan repayment assisting, and flexibility on different operating systems.

My initial impressions:

Being the visual person I am, the website initially appeared a bit overwhelming to me due to the amount of information included on the homepage. However, the main and most important points of the software are listed right at the beginning.

When you first go to download, it can be a little confusing. It might be overwhelming for those who may not be familiar with computer lingo to see discussions of Linux and the operating systems. But, relax. If you have Windows, it won’t be complicated. It should only take a couple minutes to download considering the file size is 1.92 KB.

After downloading, it was time to start using. My issue was trying to figure out how to open the program. I first looked in my documents, where I expected the file to be, but what I found were all back-end pieces to the puzzle. After going through the Start menu, though, instead of the document folder, I was able to launch the GnuCash software.

I am typically the type that catches on to technology and new programs fairly easily; however, this looked a little intimidating. I was not too concerned, though, since the website contains a section titled “Documentation,” where you can find a help manual and tutorial to get you started should you need it. As I started to set up my accounts, the assistant guided me along in a straightforward manner, which I liked.

How it works:

To get started using GnuCash, you first need to go through the setup. The guide that automatically pops up directs you on what to click on next. If you aren’t familiar with accounting, you may have a hard time understanding certain aspects of the setup, but, again, the help tutorial should be able to assist you with more details of the software.

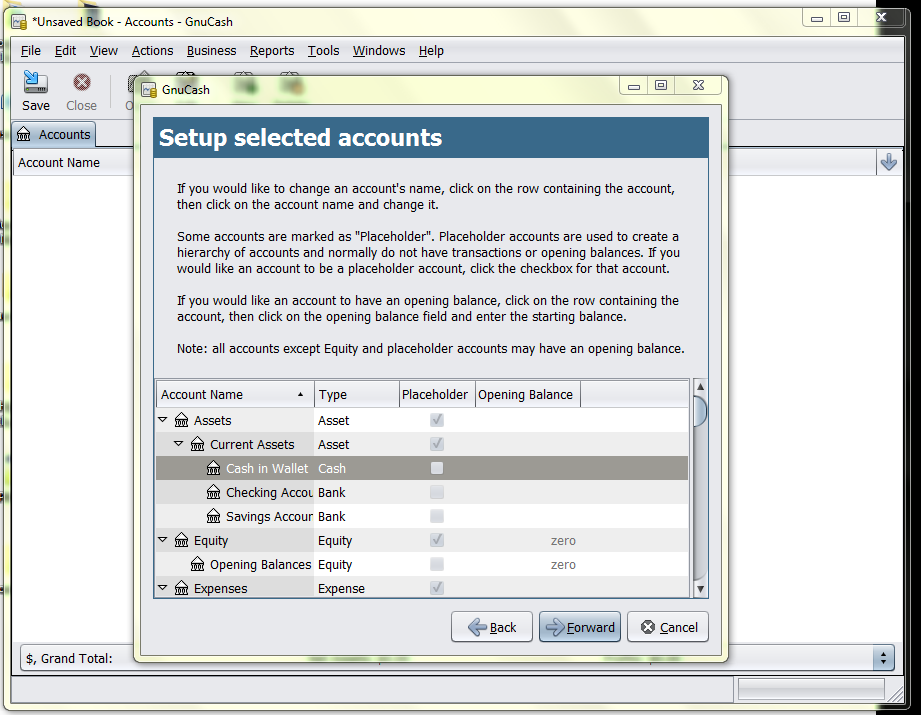

You’ll be prompted to set up your account hierarchy, at which point you’ll have the option to use trading accounts or split accounts. Following this, you will choose accounts to create. If you’re using this for personal expense tracking, you would select “Common Accounts,” but you may select more. I included my college loans in mine since that is my only debt currently.

Although a time-consuming process, enter your numbers here. You can, of course, import a CSV file from your bank account(s) as well, which can then be organized in your data sheet. When you get the file in from your bank or credit card statements, you will then be able to categorize each into as specific of details as you would like. For instance, you could create a category like Expenses: Bills/StudentLoans. Unfortunately, you have to sort these out one by one as well, and uploading the files can also be a bit of a process.

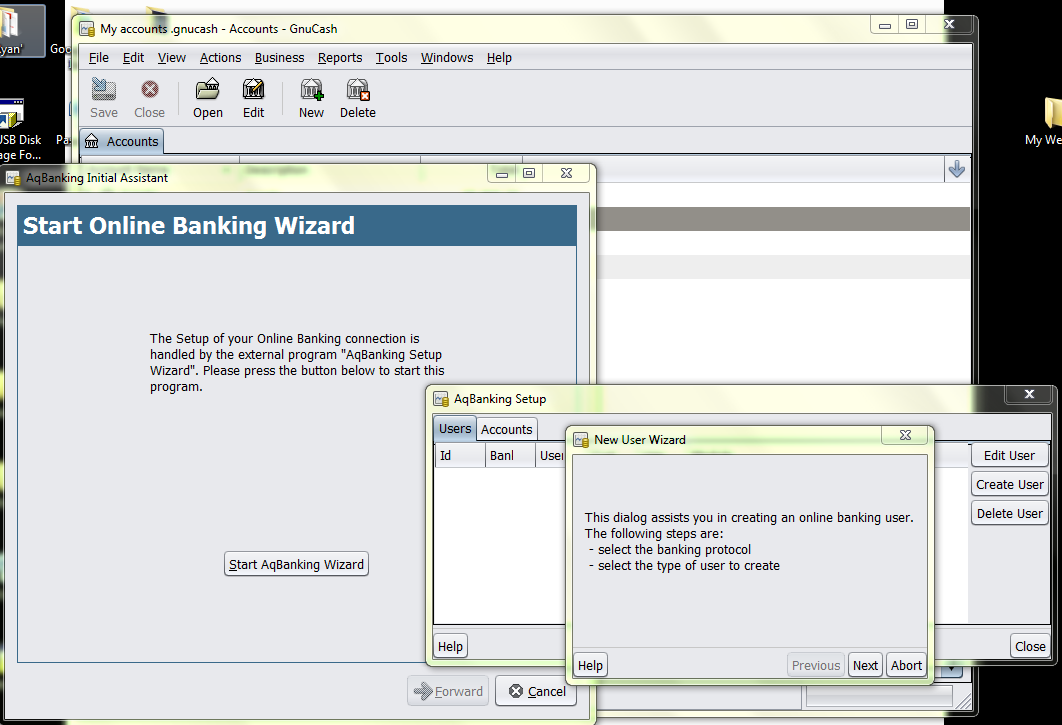

In addition to uploading the file from your bank, you can connect your bank account through the Tools tab.

You will be lead through a series of steps to complete the process. Buyer beware, though; the third party they use to access your account, known as OFX Direct, may include a $9.95 monthly charge. Considering it is free to use the rest of the software, this may be worth the cost.

To do a manual entry, simply click on the area under “Opening Balance” and type the number in the text box that appears. Note that some accounts are meant to be what GnuCash calls “Placeholders,” that is, a holder until you get the information. This is explained in the description above the columns. Again, the main purpose of this section is to establish your hierarchy.

As you finish this setup, the software automatically converts this information into an XML file, having you save it in your documents. Then, in GnuCash, your information is documented, and your net profit is already there for you to view based on the numbers you entered.

From here, it is managing, analyzing, and reporting.

Would I recommend it?

Even though I am a detail-oriented person, this software may have a little too much going on all at once for me. Also, when I attempted to upload a CSV file, it was fairly time-consuming. But, many aspects of GnuCash are much simpler than they look. As you start a new task, such as performing a transfer, it appears to be daunting but actually is easy. In general, the layout is a bit complicated, but one may argue the same of Quickbooks, another accounting program geared toward businesses.

The GnuCash software does provide essentially everything you need to balance your books. It can even be used in multiple languages, which I view as another bonus. What holds it back is the time it takes to set up and its lack of convenience. If you are on a budget, though, especially for your start-up business, this may be a viable option.

Lastly, you may want to save reviewing the tutorials one by one and only look for the answers you truly need for your situation. There are pages among pages, and it’d be easier to learn as you go rather than try to absorb the information all at once.

I would need to utilize GnuCash for a few months and compare it side by side with a program like Quickbooks to see if it truly is beneficial or a right fit for me. Despite the fact that I do understand there is a learning curve for most things, especially in business, time is also money. If I spend or waste too much time trying to figure out one program, free may actually end up costing me more in the long haul.

If you’re looking for something extremely user-friendly, GnuCash may not be for you. Conversely, if you need something extremely detailed and you have basic accounting skills, it is worth trying out.

Have you ever tried GnuCash before? Would you recommend it?

Photo Credit: Mark Wilson

Jenn Clark is a writer, PR specialist, entrepreneur, blogger and coffee enthusiast. A lover of laughter, traveling and cheese, she’s written about her life experiences here at suburbanfinance while at the same time growing other young professionals. You can find more of her work at Jennblogs.co.

GnuCash seems a good software. I was at first hesitant using the software, but because of your review, I think I am gonna give it a try. Thanks for your review.